Embark on a journey into the cutting-edge domain of financial innovation, where AI traders are rewriting the rules of investment strategy. In the fast-paced realm of modern markets, AI traders represent a seismic shift, harnessing advanced technologies and data-driven methodologies to redefine the art of trading. From intricate machine learning algorithms to lightning-fast decision-making capabilities, AI traders stand at the vanguard of revolutionizing how we navigate the complexities of the financial landscape.

In this comprehensive guide, we invite you to delve deep into the dynamic world of AI trading, where we uncover the foundational principles, sophisticated strategies, illuminating case studies, and forward-looking trajectories that underpin this rapidly evolving field. Whether you’re a seasoned investor seeking to optimize your trading methodologies or an inquisitive newcomer eager to explore the potential of AI trading, this guide serves as your indispensable companion, offering invaluable insights and actionable steps to navigate the intricacies of AI-driven trading with confidence and clarity.

Join us as we unravel the intricacies of AI-driven trading, dissecting the underlying strategies, cutting-edge technologies, and emerging trends that are reshaping the landscape of finance. From mastering the fundamentals of AI trading to exploring real-world case studies and envisioning the future trajectory of this transformative field, this guide empowers you with the knowledge and tools needed to embark on your own AI trading odyssey.

Prepare to unlock new frontiers, elevate your trading prowess, and stay at the forefront of innovation in today’s dynamic financial markets. Let’s embark on a journey into the realm of AI trading and discover how artificial intelligence is revolutionizing the way we trade and invest.

Table of Contents

Understanding AI Traders

AI traders, often referred to as algorithmic trading systems or automated trading systems, leverage artificial intelligence to make trading decisions and execute trades at speeds and volumes that far exceed human capabilities. By integrating advanced algorithms, AI traders analyze large datasets to identify trading opportunities based on market conditions and historical data.

What is an AI Trader?

An AI trader utilizes machine learning, a subset of AI, to predict market trends and make data-driven trading decisions. These systems are programmed to recognize patterns and can continuously learn and adapt from data without human intervention. The core advantage is their ability to process and analyze data across multiple markets in real-time, leading to more informed and timely trading decisions.

Source: Medium

How Do AI Traders Work?

AI traders operate using algorithms that are designed to identify profitable trading opportunities based on quantitative data. These algorithms can vary widely but typically include components of statistical analysis, predictive analytics, and probabilistic forecasting. Commonly, AI traders are employed in high-frequency trading (HFT) where they execute large volumes of orders at very high speeds, using complex algorithms to analyze multiple markets simultaneously.

The Role of Machine Learning

Machine learning in trading involves creating models that can predict market movements by recognizing complex patterns in data that are not apparent to human traders. These models are trained using historical market data and continually refined as new data becomes available, allowing them to improve over time.

The use of AI traders is revolutionizing the field of stock trading by enhancing the speed and accuracy of market analysis, which can lead to more strategic trading decisions. As these systems evolve, their predictive capabilities and operational efficiencies are expected to grow, making them an increasingly integral part of modern trading strategies. For anyone involved in trading, understanding the mechanisms and potential of AI traders is crucial for adapting to the rapidly changing landscape of the financial markets.

Benefits of AI in Stock Trading

Artificial Intelligence (AI) is reshaping the landscape of stock trading with its ability to analyze vast amounts of data rapidly and make decisions in real-time. The integration of AI into trading platforms offers several significant benefits that enhance both the efficiency and effectiveness of market operations.

Enhanced Market Efficiency

AI traders can process and analyze data at a speed that is impossible for human traders. This capability allows for the execution of trades at optimal prices, minimizing spreads and increasing market liquidity. AI systems can identify trends and patterns in large datasets quickly, enabling traders to react instantly to market changes.

Increased Accuracy and Reduced Errors

AI algorithms help reduce the likelihood of human error, which is a significant factor in trading losses. Automated systems follow the trading plan without deviation, ensuring consistency in trading activities. Moreover, AI can help in predictive accuracy, identifying profitable trading opportunities by analyzing historical data and trends.

Risk Management

AI can enhance risk management strategies by predicting potential market downturns and providing scenario analysis under different market conditions. These systems can adapt to new data, allowing them to evolve their trading strategies in real-time to mitigate potential losses.

Cost Reduction

By automating routine trading and data analysis tasks, AI can significantly reduce operational costs associated with human traders, including salaries and related expenses. Additionally, AI’s ability to execute trades more efficiently helps minimize slippage costs—the difference between the expected price of a trade and the price at which the trade is executed.

24/7 Trading Capability

Unlike human traders, AI systems do not need breaks and can operate around the clock. This feature is particularly beneficial in the global trading environment where different markets operate in various time zones, allowing traders to take advantage of opportunities that occur outside of regular trading hours.

The benefits of AI in stock trading are transforming the industry, making it more dynamic, precise, and efficient. As technology continues to evolve, the role of AI in trading will likely expand, further revolutionizing how trading decisions are made and executed in the financial markets.

AI Trading Strategies

Artificial Intelligence (AI) trading strategies leverage advanced algorithms to analyze market data and make trading decisions with speed and precision. These strategies have evolved significantly in recent years, offering traders innovative approaches to capitalize on market opportunities. Here are some key AI trading strategies employed in the financial markets:

Trend Following

Trend-following strategies involve identifying and capitalizing on market trends by analyzing historical price data. AI algorithms can detect patterns and trends in large datasets, enabling traders to enter positions in the direction of the prevailing trend. These strategies aim to ride the momentum of price movements and profit from extended trends in the market.

Mean Reversion

Mean reversion strategies exploit the tendency of asset prices to revert to their historical mean over time. AI algorithms identify instances where prices deviate significantly from their average values and execute trades with the expectation that prices will eventually revert to the mean. These strategies are based on the assumption that extreme price movements are temporary and will eventually correct.

Sentiment Analysis

Sentiment analysis strategies involve analyzing news articles, social media posts, and other sources of market sentiment to gauge investor sentiment and predict market movements. AI algorithms can process vast amounts of textual data and extract sentiment signals, allowing traders to make informed decisions based on market sentiment indicators.

Pattern Recognition

Pattern recognition strategies rely on AI algorithms to identify recurring patterns and formations in price charts, such as triangles, head and shoulders, and flags. These patterns are indicative of potential future price movements, and traders use them to identify entry and exit points for trades. AI-driven pattern recognition algorithms can scan large datasets and identify patterns that may not be apparent to human traders.

Arbitrage

Arbitrage strategies capitalize on price discrepancies between different markets or assets to generate profits with minimal risk. AI algorithms can identify arbitrage opportunities by analyzing prices across multiple exchanges or financial instruments in real-time. These strategies require fast execution and sophisticated risk management techniques to exploit fleeting opportunities in the market.

Machine Learning and Predictive Analytics

Machine learning and predictive analytics strategies involve training AI algorithms to analyze historical market data and make predictions about future price movements. These algorithms continuously learn from new data and adapt their trading strategies accordingly, aiming to anticipate market trends and exploit profitable trading opportunities.

AI trading strategies offer traders a wide range of tools and techniques to navigate the complexities of the financial markets. By leveraging advanced algorithms and machine learning techniques, traders can gain a competitive edge and improve their trading performance in today’s dynamic and rapidly evolving market environment.

Challenges and Limitations

Despite the numerous advantages that AI brings to stock trading, there are several challenges and limitations that traders and investors need to consider when utilizing AI systems.

Overfitting and Data Bias

One of the primary challenges in AI trading is overfitting—the phenomenon where a model performs well on historical data but fails to generalize to new, unseen data. Overfitting can lead to inaccurate predictions and poor performance in live trading environments. Additionally, AI models may be susceptible to biases present in the training data, resulting in skewed predictions and investment decisions.

Dependency on Historical Data

AI traders rely heavily on historical market data for training and decision-making. While this data provides valuable insights into past market behavior, it may not accurately reflect future market conditions, especially during unprecedented events or market disruptions. Traders must be cautious of the limitations of historical data and consider how AI systems adapt to new market environments.

Lack of Human Judgment

While AI excels in processing large datasets and identifying patterns, it lacks the intuitive judgment and qualitative analysis that human traders possess. AI systems may struggle to interpret complex market events, news sentiment, or geopolitical factors that could impact trading decisions. Human oversight and intervention are essential to supplement AI’s capabilities and ensure prudent decision-making.

Regulatory and Ethical Considerations

The use of AI in trading raises regulatory and ethical concerns regarding market manipulation, fairness, and accountability. Regulators are grappling with the challenge of effectively overseeing AI-driven trading activities and ensuring compliance with existing regulations. Additionally, there are ethical considerations surrounding the use of AI in making high-stakes financial decisions, particularly in cases where the algorithms’ decision-making processes are opaque or biased.

Navigating these challenges requires careful consideration of the capabilities and limitations of AI systems, along with robust risk management strategies and regulatory compliance measures. While AI has the potential to revolutionize stock trading, addressing these challenges is crucial to realizing its full benefits while minimizing risks.

Case Studies of AI in Action

Real-world examples demonstrate the effectiveness and impact of AI-driven trading strategies across various financial markets. Here are some notable case studies highlighting successful implementations of AI in trading:

Renaissance Technologies’ Medallion Fund

Renaissance Technologies’ Medallion Fund is one of the most successful hedge funds globally, known for its extensive use of AI and quantitative trading strategies. The fund’s AI-driven approach analyzes vast amounts of market data to identify patterns and trends, enabling it to consistently outperform traditional investment strategies. Despite being closed to outside investors, the Medallion Fund has generated exceptional returns for its employees.

Bridgewater Associates’ Pure Alpha Fund

Bridgewater Associates’ Pure Alpha Fund utilizes AI and machine learning techniques to manage its global macro investment strategy. The fund’s AI-driven models analyze economic data, market sentiment, and geopolitical events to identify investment opportunities across various asset classes. This approach has helped the Pure Alpha Fund achieve consistent returns and navigate turbulent market conditions successfully.

Two Sigma Investments

Two Sigma Investments is a quantitative investment firm that heavily relies on AI and machine learning algorithms to drive its trading strategies. The firm’s AI-driven models analyze vast amounts of data, including market prices, economic indicators, and alternative data sources, to identify alpha-generating opportunities. Two Sigma’s systematic approach to trading has enabled it to achieve impressive returns for its investors.

DE Shaw’s Investment Strategies

DE Shaw is a global investment firm known for its innovative use of AI and machine learning in its investment strategies. The firm’s AI-driven models analyze market data in real-time to identify mispriced assets and execute trades with precision. DE Shaw’s systematic approach to trading has helped it deliver consistent returns across various market conditions.

QuantConnect’s Algorithmic Trading Platform

QuantConnect is an online platform that allows traders and investors to develop and backtest AI-driven trading algorithms. The platform provides access to historical market data, a comprehensive library of technical indicators, and a cloud-based infrastructure for running trading algorithms. QuantConnect’s user-friendly interface and powerful backtesting capabilities make it a popular choice among algorithmic traders.

These case studies demonstrate the diverse applications of AI in trading and the significant impact it can have on investment performance. By harnessing the power of AI-driven algorithms and machine learning techniques, investment firms and individual traders can gain a competitive edge and achieve superior returns in today’s dynamic and complex financial markets.

Future of AI Traders

Future of AI Traders

The future of AI traders holds immense potential for transforming the landscape of financial markets and revolutionizing the way trading is conducted. Here are some key trends and developments shaping the future of AI traders:

Advanced Machine Learning Techniques

Advancements in machine learning techniques, such as deep learning and reinforcement learning, are expected to enhance the capabilities of AI traders. These techniques enable AI algorithms to extract deeper insights from complex data sets, leading to more accurate predictions and better decision-making in trading.

Big Data and Alternative Data Sources

The proliferation of big data and alternative data sources will provide AI traders with a wealth of information to analyze and interpret. By incorporating data from sources such as social media, satellite imagery, and IoT devices, AI traders can gain unique insights into market trends and sentiment, allowing for more informed trading decisions.

Real-Time Decision-Making

AI traders will continue to evolve towards real-time decision-making capabilities, enabling them to react swiftly to changing market conditions and execute trades with precision. With advancements in computing power and algorithmic efficiency, AI traders can analyze market data in milliseconds, giving them a competitive advantage in high-frequency trading environments.

Explainable AI

As AI traders become more prevalent in financial markets, there will be an increasing demand for explainable AI—AI systems that can provide transparent explanations for their decision-making processes. Explainable AI will help build trust and confidence among traders and regulators, ensuring accountability and mitigating the risks associated with opaque trading algorithms.

Regulatory Considerations

Regulators will play a crucial role in shaping the future of AI traders by establishing guidelines and standards for their operation. As AI traders become more sophisticated, regulators will need to ensure that they adhere to existing regulations and do not engage in manipulative or predatory trading practices. Regulators may also need to develop new frameworks to address the unique challenges posed by AI-driven trading.

Ethical and Social Implications

The widespread adoption of AI traders will raise ethical and social implications that need to be addressed. Questions surrounding fairness, transparency, and accountability will become increasingly important as AI traders play a more significant role in financial markets. It will be essential for market participants to consider the ethical implications of AI trading and ensure that it benefits society as a whole.

The future of AI traders is filled with promise and opportunity, but it also presents challenges that must be addressed thoughtfully. By harnessing the power of advanced machine learning techniques, embracing big data and alternative data sources, and prioritizing transparency and accountability, AI traders have the potential to revolutionize the way trading is conducted and drive innovation in financial markets for years to come.

How to Get Started with AI Trading

Embarking on the journey of AI trading can be an exciting and rewarding endeavor, but it requires careful planning and execution. Here’s a step-by-step guide to help you get started with AI trading:

1. Educate Yourself

Begin by gaining a solid understanding of AI trading principles, strategies, and technologies. Familiarize yourself with key concepts such as machine learning, algorithmic trading, and quantitative finance. There are numerous online resources, courses, and books available to help you build your knowledge base.

2. Choose a Trading Platform

Select a trading platform or software that supports AI-driven trading strategies. Look for platforms with robust backtesting capabilities, real-time data feeds, and integration with machine learning libraries. Popular options include QuantConnect, MetaTrader, and Interactive Brokers.

3. Learn Programming Skills

Develop proficiency in programming languages commonly used in AI trading, such as Python and R. These languages are versatile and widely used in data analysis, machine learning, and algorithmic trading. Take online courses or tutorials to improve your coding skills and familiarize yourself with relevant libraries like TensorFlow and scikit-learn.

4. Collect and Analyze Data

Gather historical market data from reliable sources to train your AI models. Consider incorporating alternative data sources, such as social media sentiment, news articles, and economic indicators, to enrich your dataset. Use statistical analysis and data visualization techniques to gain insights into market trends and patterns.

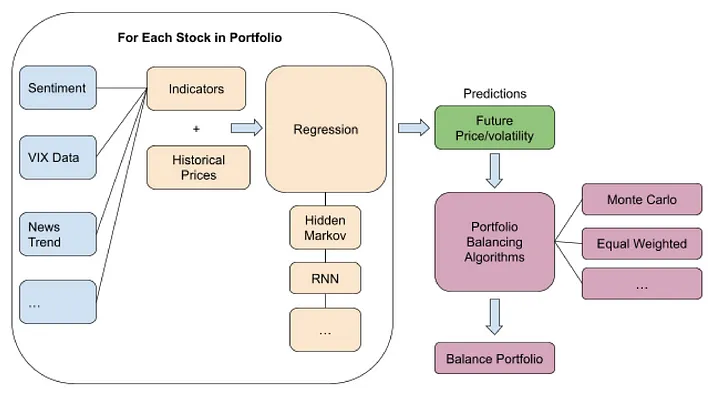

5. Build and Test AI Models

Develop AI-driven trading models using machine learning algorithms such as regression, classification, and clustering. Experiment with different models, parameters, and features to optimize performance. Backtest your models using historical data to evaluate their effectiveness and refine your strategies accordingly.

6. Implement Risk Management Strategies

Prioritize risk management in your AI trading approach to protect your capital and minimize losses. Implement measures such as stop-loss orders, position sizing, and portfolio diversification to manage risk effectively. Consider incorporating risk-adjusted performance metrics into your trading strategies to ensure long-term sustainability.

7. Monitor Performance and Adapt

Continuously monitor the performance of your AI trading models in live trading environments. Analyze trade outcomes, evaluate performance metrics, and identify areas for improvement. Be prepared to adapt and refine your strategies based on market dynamics, changing conditions, and feedback from your trading system.

8. Stay Informed and Evolve

Stay informed about advancements in AI technology, market trends, and regulatory developments relevant to AI trading. Continuously seek opportunities to expand your knowledge, explore new trading strategies, and refine your skills. Embrace a growth mindset and remain adaptable to thrive in the dynamic world of AI trading.

By following these steps and dedicating time and effort to your AI trading journey, you can embark on a path towards building successful and profitable trading strategies powered by artificial intelligence. Remember that AI trading is a journey of continuous learning and improvement, so stay patient, persistent, and open to new opportunities along the way.

Conclusion

In conclusion, AI trading represents a transformative force in the world of finance, offering traders and investors unprecedented opportunities to leverage advanced technologies and data-driven strategies for enhanced decision-making and profitability. As we’ve explored, the future of AI traders holds immense promise, with advancements in machine learning, big data analytics, and real-time processing shaping the landscape of financial markets.

However, it’s essential to approach AI trading with caution and diligence, recognizing the challenges and risks inherent in algorithmic trading. From navigating regulatory considerations to addressing ethical implications, the journey of AI trading requires a balanced approach that prioritizes transparency, accountability, and ethical responsibility.

As you embark on your journey into AI trading, remember the importance of continuous learning, adaptability, and risk management. Stay informed about the latest developments in AI technology and market trends, and be prepared to evolve your strategies in response to changing conditions.

By following the steps outlined in this guide and embracing a mindset of innovation and resilience, you can position yourself for success in the dynamic world of AI trading. Whether you’re a seasoned trader or a newcomer to the world of finance, AI trading offers exciting opportunities to explore, innovate, and thrive in the ever-evolving landscape of financial markets.

Call to Action

Ready to dive into the world of AI trading? Take the first step towards mastering AI-driven strategies and unlocking new opportunities in the financial markets. Explore our list of Best Blockchain Books for actionable insights and practical tips to kickstart your journey.

Join our community of traders and investors dedicated to harnessing the power of artificial intelligence to achieve their financial goals. Subscribe to our newsletter for regular updates, exclusive content, and expert insights into the latest trends and developments in AI trading.

Don’t miss out on the future of finance—embrace AI trading today and position yourself for success in the dynamic world of financial markets. Start your journey with us and unlock the potential of AI-driven trading strategies to elevate your trading performance and drive sustainable growth.