In 2024, choosing the right financial management tool is crucial, and the “YNAB vs Monarch” debate is at the forefront of this decision-making process. These tools offer tailored solutions to enhance personal budgeting and financial planning. This detailed comparison between YNAB and Monarch will explore their respective features, costs, and user experiences to help you determine which platform aligns best with your financial objectives. Whether you’re a seasoned budgeter or just starting to take control of your financial life, understanding the nuances of these popular tools can empower you to make an informed choice that maximizes your financial potential.

Table of Contents

What is YNAB?

YNAB, which stands for You Need A Budget, is a comprehensive budgeting tool that emphasizes a proactive approach to personal finance management. Developed with the philosophy that every dollar should have a job, YNAB helps users to actively plan their spending and gain control over their finances by assigning their incoming money to specific expenses and savings goals.

The core of YNAB’s methodology is based on four simple rules: Give Every Dollar a Job, Embrace Your True Expenses, Roll With The Punches, and Age Your Money. These rules encourage users to think ahead, adapt as circumstances change, and build financial resilience over time.

YNAB is not just about recording what you’ve already spent—it’s about planning and adjusting future spending to ensure you’re always moving towards your financial goals. This proactive approach helps prevent overspending and stress about money, making it a popular choice among those looking to improve their financial health.

The tool offers both a web-based platform and a mobile app, ensuring users can keep track of their budgets wherever they are. With features that support detailed reporting, real-time tracking, and goal-setting, YNAB provides a structured yet flexible framework for managing personal finances.

What is Monarch?

Monarch is a modern financial management tool designed to help users take complete control of their financial lives. Unlike traditional budgeting apps, Monarch offers a comprehensive approach by integrating budgeting, investment tracking, and net worth analysis into a single platform.

One of Monarch’s key features is its ability to connect all aspects of a user’s financial profile. This includes bank accounts, credit cards, investments, and real estate, providing a holistic view of one’s finances. The platform uses this integrated data to offer personalized insights and recommendations, helping users optimize their spending and saving strategies.

Monarch stands out for its visual appeal and ease of use. The tool’s interface is clean and intuitive, making it accessible for both beginners and experienced users who wish to maintain a detailed financial plan.

By offering tools that go beyond simple budgeting, Monarch is particularly suited for users who want a more dynamic and proactive approach to managing their money.

Key Features of YNAB

YNAB (You Need A Budget) distinguishes itself with a unique approach to budget management that encourages proactive financial habits. Here are the key features that set YNAB apart in the crowded field of budgeting tools:

- Rule-Based Budgeting: YNAB’s methodology is built around four fundamental rules: Give Every Dollar a Job, Embrace Your True Expenses, Roll With The Punches, and Age Your Money. These principles help users effectively plan their spending, save for big expenses over time, adjust budgets as needed, and build a financial cushion. This strategic framework encourages thoughtful spending and diligent saving.

- Real-Time Tracking: Each transaction you make is immediately recorded and categorized in YNAB, allowing for an up-to-the-minute view of your financial status. This feature is crucial for maintaining an accurate budget, as it helps you see where your money goes and ensures you stay on track with your financial goals.

- Goal-Setting Tools: Setting financial goals is integral to effective budgeting, and YNAB supports this with tools that help users define and track their savings objectives. Whether it’s for debt repayment, saving for a vacation, or building an emergency fund, YNAB offers visual progress indicators and reminders to keep you motivated and focused.

- Educational Resources: Unlike many other budgeting tools, YNAB provides extensive educational resources that help users deepen their understanding of personal finance. This includes free online workshops, blog posts, and a supportive community forum. These resources are invaluable for both beginners and experienced budgeters looking to refine their financial skills.

- Mobile Accessibility: With its robust mobile app, YNAB ensures that users can manage their budgets from anywhere. The app offers full functionality, allowing you to enter transactions, check budgets, and view reports right from your smartphone, making it easy to stay engaged with your finances on the go.

By integrating these features, YNAB not only aids in daily budget management but also empowers users with the tools and knowledge to achieve long-term financial stability.

Key Features of Monarch

Monarch is a versatile financial management platform that offers an integrated solution for users to manage all aspects of their finances. Here are the key features that distinguish Monarch from other budgeting tools:

- Comprehensive Financial Overview: Monarch integrates all your financial accounts—including bank accounts, credit cards, investments, and real estate—into one platform. This integration helps users monitor their total net worth and track financial changes over time in a single, cohesive view.

- Interactive Budgeting and Forecasting: The platform provides advanced budgeting tools that allow users to create and modify budget categories easily. Monarch’s forecasting feature uses historical financial data to predict future trends and spending, aiding users in more accurate financial planning.

- Goal Setting and Tracking: Users can set and monitor financial goals within Monarch, such as saving for a vacation, building an emergency fund, or paying off student loans. The platform offers progress trackers and visual representations to motivate users and help manage their achievements.

- Investment Analysis: Monarch excels in investment tracking, providing users with detailed analyses of their portfolio’s performance, including comparisons to market benchmarks and insights tailored to their specific investment strategies.

- Custom Alerts and Notifications: The platform enables users to set customized alerts for various financial activities, such as budget thresholds, large transactions, or significant investment changes. These notifications help users stay proactive and responsive to their financial situation.

- Security and Privacy: Monarch prioritizes user security with advanced encryption methods to protect personal and financial data. The platform’s privacy features allow users to control how their data is used and shared, ensuring a secure financial management experience.

Monarch’s robust and comprehensive features make it an excellent choice for individuals who need a more dynamic and integrated approach to managing their finances. Its capabilities extend beyond simple budgeting, offering tools that support sophisticated financial analysis and decision-making.

Comparing the User Interface: YNAB vs Monarch

When choosing a budgeting tool, the user interface (UI) is a critical factor as it impacts how easily users can navigate the software and manage their finances effectively. Both YNAB and Monarch offer distinct UI designs aimed at enhancing user experience, but they cater to different user preferences and needs. Here’s a detailed comparison of the user interfaces of YNAB and Monarch:

YNAB’s User Interface

YNAB’s interface is designed with simplicity and clarity in mind. It focuses on direct interaction with your budget, displaying all categories and transactions clearly and concisely. The UI is minimalist, reducing clutter to prevent users from feeling overwhelmed while managing their finances. YNAB also emphasizes educational prompts throughout the interface, which guide users on how to effectively use the budgeting tool to its full potential.

- Strengths: The straightforward layout makes it easy for beginners to understand and use. The emphasis on budgeting education within the UI helps users not just follow but understand their financial habits and needs.

- Weaknesses: Some users may find the functionality too basic if they are looking for more comprehensive financial management tools beyond budgeting.

Monarch’s User Interface

In contrast, Monarch provides a more visually-rich interface that integrates charts, graphs, and a dashboard that offers a quick overview of your financial health at a glance. The design is sleek and modern, appealing to users who appreciate a more visually engaging presentation of data. Monarch’s interface also facilitates deeper insights into financial trends and investments, which are easily accessible through its detailed menus and options.

- Strengths: The dynamic interface is great for users who need a holistic view of their financial status, including investments and assets, in one place. The visually appealing design enhances user engagement and makes financial management more intuitive.

- Weaknesses: New users might initially find the detailed interface a bit complex, especially if they are not familiar with using advanced financial tools.

User Interface Usability

From a usability perspective, YNAB might be more suitable for users who prefer a no-frills approach that keeps budgeting straightforward and focused. On the other hand, Monarch might appeal more to those who are seasoned in managing finances and prefer a comprehensive overview that includes detailed analyses and forecasts.

Overall, the choice between YNAB and Monarch’s UIs will depend largely on personal preference and specific financial management needs. Users should consider not only what each interface offers but how it aligns with their daily financial tracking habits and long-term financial goals.

Cost Comparison: YNAB vs Monarch

When evaluating budgeting tools like YNAB and Monarch, cost is an essential factor that can influence a user’s decision. Both tools offer different pricing structures and features, making it important to understand what each provides for the money spent. Here’s a breakdown of the costs associated with YNAB and Monarch

YNAB’s Pricing

YNAB adopts a subscription-based pricing model. As of 2024, YNAB charges $99 per year, though they offer a 34-day free trial to allow new users to explore the tool before committing financially. This annual fee includes full access to all features, including budgeting, real-time tracking, goal setting, and a wealth of educational resources. YNAB also offers a monthly subscription option, charging $14.99 a month ($179,88 a year).

Value Proposition: The cost includes access to highly detailed budget management tools and a focus on financial education, which can justify the annual expense for users dedicated to changing their financial habits.

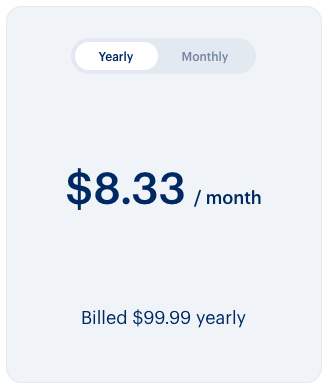

Monarch’s Pricing

Monarch provides a tiered pricing model with a monthly and an annual subscription option. The monthly fee is around $14.99, while the annual subscription offers a discounted rate of $99.99 per year. Monarch also typically offers a 7-day free trial, which is shorter than YNAB’s but still provides an opportunity to test the tool’s features.

Value Proposition: Monarch’s cost grants access to comprehensive financial oversight tools, including investment tracking and net worth calculation, making it suitable for users looking for an all-in-one financial management platform.

Evaluating Cost vs. Features

Comparing YNAB and Monarch involves more than just looking at the numbers; it’s about assessing which tool provides the features that best meet your financial management needs. YNAB is highly focused on budgeting and educational resources, making it ideal for users who want to develop stringent budgeting habits. Monarch, with its broader scope, might be better suited for those who are interested in an all-encompassing view of their finances, including tracking investments and overall net worth.

The choice between these tools should consider both the financial outlay and the specific financial management capabilities each offers. This detailed cost analysis helps users determine which tool offers the best value for their individual financial situations.

Customization Capabilities

Customization is a key feature in budgeting tools, allowing users to tailor their financial management systems to match their personal or family budgets, spending habits, and financial goals. Both YNAB and Monarch offer customization options, but they do so in different ways, catering to diverse user needs. Here’s a look at the customization capabilities of YNAB and Monarch:

YNAB’s Customization Options

YNAB is highly regarded for its adaptability in budgeting. It allows users to create and modify budget categories based on their unique financial situations. Each category can be adjusted as needed, allowing for changes in income or expenses. Users can also set specific goals for each category, enabling precise tracking and management of financial objectives.

- Flexibility in Budgeting: YNAB’s flexibility is particularly useful for those who have irregular income or who experience frequent changes in their financial landscape. It encourages users to adjust their budgets in real time, which is crucial for staying on track financially.

- Goal-Oriented Tracking: By allowing users to assign goals to each budget category, YNAB makes it easy to see progress and stay motivated, enhancing the overall budget management experience.

Monarch’s Customization Options

Monarch goes beyond traditional budgeting to offer extensive customization in tracking not just expenses but also investments and overall net worth. Users can link their various financial accounts to see a unified view of their finances. Monarch also allows for the creation of custom tags and filters that enable users to categorize transactions in a way that best suits their analytical needs.

- Comprehensive Financial Overview: Monarch’s ability to customize and categorize financial data across various accounts makes it an excellent tool for users who require a detailed and broad view of their finances.

- Investment Tracking Customization: With advanced features for tracking investments, Monarch users can tailor their dashboards to reflect preferred data points, such as asset classes or specific investment accounts, providing a personalized investment management experience.

Comparison of Customization Features

While YNAB focuses on highly flexible budgeting that adapts to changes in the user’s financial situation, Monarch offers broader customization capabilities that encompass all aspects of financial management. Monarch’s approach is particularly beneficial for those who need comprehensive insights into their financial health, including investments and assets, alongside traditional budgeting.

Both tools excel in their respective areas, making them ideal for different types of users: YNAB is better suited for those focused on meticulous budget management, while Monarch is excellent for users who need an all-encompassing financial overview with the ability to dive deep into financial analytics.

Integration with Other Platforms

Integration with banks, financial institutions, and other financial tools is a crucial feature for any modern budgeting software, as it significantly enhances usability and efficiency. Both YNAB and Monarch offer integration capabilities, but their approaches and the extent of integration vary. Here’s a detailed look at how YNAB and Monarch handle integration with other platforms:

YNAB’s Integration Capabilities

YNAB offers direct import options from thousands of banks, allowing users to automatically sync their transactions into the budgeting tool. This feature ensures that all transactions are up-to-date, reducing the need for manual entry and minimizing errors. YNAB also supports third-party apps and services via APIs, which can be utilized to further enhance the functionality and flexibility of the budgeting experience.

- Bank Syncing: Automatic transaction imports from banking institutions help users stay on top of their finances without the hassle of manual tracking.

- Third-Party Extensions: Through API access, users can connect YNAB with other financial tools and services, which can extend the capabilities of YNAB beyond basic budgeting.

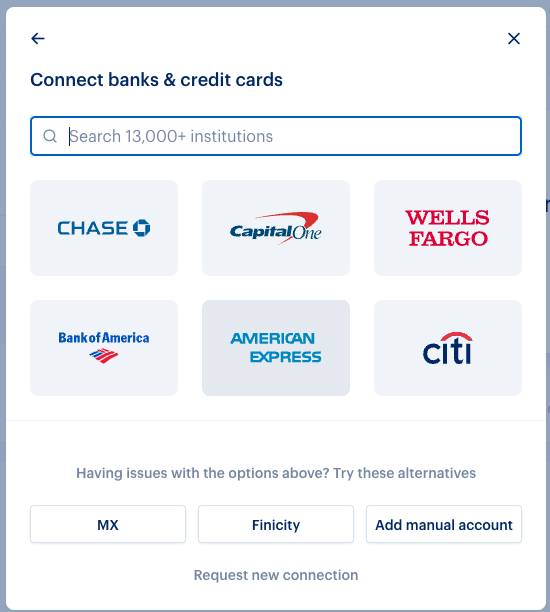

Monarch’s Integration Capabilities

Monarch excels in integration by offering connections not just with banks but also with investment platforms, real estate accounts, and more. This extensive integration allows users to have a holistic view of their entire financial portfolio in one place. The platform’s integration extends to tools like retirement calculators and other financial planning resources, which can use the aggregated data from all linked accounts to provide comprehensive financial insights.

- Comprehensive Account Syncing: Monarch integrates with a wider range of financial accounts, including investment and real estate, which are essential for users who need detailed asset management alongside their budgeting.

- Advanced Data Utilization: The ability to pull in and analyze data from various sources means that Monarch can offer sophisticated financial analytics, making it possible for users to gain deeper insights into their financial health.

Comparison of Integration Features

While YNAB focuses on the seamless integration of banking data to streamline the budgeting process, Monarch provides a broader integration scope that includes financial, investment, and real estate accounts. YNAB is ideal for users who primarily need a solid budgeting tool with essential bank syncing capabilities. In contrast, Monarch is suited for those who require a comprehensive platform that can manage and analyze multiple aspects of their financial life.

The level of integration each platform offers is key to determining which will best meet your needs. For users who want a detailed and expansive overview of their finances, Monarch’s extensive integrations may be more appealing. Conversely, for those whose primary concern is streamlined, focused budgeting, YNAB’s straightforward and efficient bank integration might be sufficient.

Security Features: YNAB vs Monarch

Security is a critical consideration for any financial management tool, as users entrust these platforms with sensitive personal and financial information. Both YNAB and Monarch prioritize security but employ different methods and features to ensure user data is protected. Here’s an overview of the security measures implemented by YNAB and Monarch:

YNAB’s Security Measures

YNAB takes the security of its users’ data seriously, implementing several robust measures to safeguard information. These include:

- Encryption: YNAB uses bank-grade 256-bit encryption to protect all data transmitted between your devices and their servers. This ensures that your financial information is secure from unauthorized access.

- Two-Factor Authentication (2FA): To provide an additional layer of security, YNAB supports two-factor authentication, requiring users to verify their identity using two different methods before accessing their accounts.

- Regular Security Audits: YNAB undergoes frequent security audits conducted by third-party security experts to ensure their defenses are always up to date and effective.

Monarch’s Security Measures

Monarch also places a high priority on security, with features designed to maintain the integrity and confidentiality of user data:

- Advanced Encryption: Similar to YNAB, Monarch uses high-level encryption technology to protect user data both in transit and at rest.

- Biometric Login Options: Monarch supports biometric authentication options, such as fingerprint scanning and facial recognition, on compatible devices, offering users a convenient and secure way to access their accounts.

- Data Anonymization: To protect privacy, Monarch anonymizes and secures personal data, ensuring that it is not identifiable back to any user without proper authorization.

Comparison of Security Features

Both YNAB and Monarch employ industry-standard security practices, but they also offer unique features that cater to different security preferences. YNAB’s approach with regular audits and strong encryption appeals to users who value rigorous security checks. Monarch’s use of biometric logins caters to those who prefer modern, tech-savvy methods for secure access.

Choosing between YNAB and Monarch should consider these security features, especially considering the level of financial data involved. Users must evaluate which security options align best with their personal security standards and the types of financial activities they perform within these tools.

Mobile App Usability

In today’s mobile-first world, the usability of mobile apps for budgeting tools like YNAB and Monarch is crucial. A well-designed mobile app can greatly enhance the user experience, allowing for convenient on-the-go budget management. Here’s how the mobile apps for YNAB and Monarch stack up in terms of usability:

YNAB’s Mobile App

YNAB’s mobile app is designed to offer a seamless extension of its desktop experience, providing users with the full functionality they need to manage their budgets anywhere, anytime. Key features include:

- User-Friendly Interface: The YNAB mobile app maintains the same clean and straightforward design as its desktop counterpart, making it easy for users to navigate and manage their budgets without confusion.

- Real-Time Synchronization: Transactions entered on the mobile app sync in real time with the desktop version, ensuring that users have up-to-date financial information across all devices.

- Comprehensive Budget Management: The app allows users to add transactions, check budget categories, and view reports, enabling complete financial management on the go.

Monarch’s Mobile App

Monarch’s app takes mobile financial management to the next level by integrating not just budgeting but also investment tracking and financial insights, making it a robust tool for comprehensive financial oversight. Features include:

- Advanced Dashboard: Monarch’s mobile app features a sophisticated dashboard that provides a quick overview of your financial health, including net worth, investment performance, and budget statuses.

- Detailed Financial Analysis: Users can delve into detailed analyses directly from the app, examining spending patterns, investment returns, and more.

- Alerts and Notifications: The app sends custom alerts regarding financial updates, market movements, and budget reminders, helping users stay informed and proactive.

Comparison of Mobile App Usability

While both apps are highly functional, YNAB’s app is particularly user-friendly, especially for those primarily interested in budgeting and basic account management. It’s ideal for users who want a straightforward, no-frills approach to mobile budgeting. In contrast, Monarch’s app offers more complex functionalities suited for users who not only want to manage budgets but also track investments and net worth dynamically.

The choice between the two apps should depend on the user’s specific needs: whether they prioritize simplicity and ease of use (YNAB) or require a more detailed financial overview with advanced features (Monarch).

Customer Support and Community

Effective customer support and an active community are essential for any financial tool, as they enhance user experience and provide valuable resources for troubleshooting and learning. YNAB and Monarch both offer support systems, but they vary in accessibility, response times, and community engagement. Here’s a look at the customer support and community aspects of YNAB and Monarch:

YNAB’s Customer Support and Community

YNAB is known for its exceptional customer support and vibrant community. Here are some highlights:

- Responsive Customer Support: YNAB provides comprehensive support via email, with detailed, personalized responses typically received within 24 hours. They also offer live chat during business hours for more immediate assistance.

- Extensive Educational Resources: YNAB excels in offering a wealth of educational content, including free live workshops, detailed help documents, and a blog filled with budgeting tips and financial advice.

- Active Online Community: The YNAB community is one of its strongest assets. Users can engage with fellow budgeters through forums, social media groups, and Reddit, providing a space to share experiences, offer solutions, and gain insights from other users.

Monarch’s Customer Support and Community

Monarch, while newer to the scene, has developed a solid support structure and is growing its community engagement:

- Customer Support Options: Monarch offers support primarily through email, with plans to expand its services as the user base grows. They aim for quick response times and are known for their thorough and helpful customer service.

- Growing Community Resources: Although smaller, Monarch’s user community is active and engaged, particularly on platforms like Twitter and through their own user forums. They are also starting to produce more educational content tailored to their user base’s needs.

- Regular Updates and Feedback Loops: Monarch actively uses customer feedback to improve its platform, regularly updating its software to add features requested by users and enhance usability based on direct community input.

Comparison of Customer Support and Community

YNAB’s well-established support and community network provide an excellent resource for both novice and experienced budgeters, making it particularly appealing to users who value a supportive learning environment. Monarch, on the other hand, while still developing its community and support offerings, shows promise with its responsive service and commitment to incorporating user feedback into its development process.

Choosing between YNAB and Monarch may come down to the level of support and community engagement a user expects. YNAB might be the better choice for those who value a broad array of learning resources and a well-established, supportive community. Monarch is suitable for users who appreciate a more personalized customer service experience and like being part of a growing community that directly influences product development.

Pros and Cons of YNAB

When considering a budgeting tool like YNAB, it’s important to weigh both the advantages and the disadvantages to see if it aligns with your personal finance management needs. YNAB offers a distinctive approach to budgeting that emphasizes proactive financial planning and strong educational support. However, every tool has its limitations along with its strengths. Below, we explore the pros and cons of using YNAB to help you decide if it is the right choice for your budgeting journey.

Pros of YNAB

- Proactive Budgeting Philosophy: YNAB’s core approach is to “Give Every Dollar a Job,” which helps users actively plan and allocate their funds to various budget categories ahead of spending. This methodology encourages users to live within their means and save more effectively.

- Robust Educational Support: YNAB offers extensive educational resources to help users master budgeting and personal finance. This includes free live workshops, detailed video tutorials, and a variety of written guides that are accessible directly through its app and website.

- Real-Time Transaction Updates: The app syncs transactions across all devices in real-time, ensuring users always have the most current view of their finances. This feature is crucial for maintaining an accurate budget.

- Goal-Setting Tools: YNAB allows users to set specific financial goals within the app, making it easier to track progress and stay motivated, whether saving for a down payment, reducing debt, or planning for retirement.

- Active Community and Forums: YNAB boasts a supportive and active community. Users have access to forums and social media groups where they can exchange tips, share financial advice, and find encouragement from other YNAB users.

Cons of YNAB

- Subscription Fee: YNAB does not offer a free version; it requires a subscription fee of $99 per year, which may be a hurdle for users looking for a free budgeting tool.

- Initial Learning Curve: The unique budgeting approach of YNAB can take some time for new users to understand and implement effectively, especially for those accustomed to more traditional budgeting methods.

- Limited Investment Tracking Capabilities: YNAB focuses primarily on budgeting and does not offer extensive tools for investment tracking, which may not satisfy users who want an all-encompassing financial management tool.

- No Monthly Subscription Option: YNAB only offers an annual subscription, which means users need to commit financially for a full year, potentially discouraging those who prefer monthly billing.

These pros and cons highlight YNAB’s strong focus on budget management and education, appealing to users who need help structuring their finances and those who appreciate community support. However, its pricing and focused feature set may not meet everyone’s needs, particularly those looking for investment features or a less rigid budgeting approach.

Pros and Cons of Monarch

Monarch is a comprehensive financial management platform designed to offer users a full view of their financial landscape. While it stands out for its all-in-one approach to managing budgets, investments, and overall net worth, it’s important to assess both the benefits and potential drawbacks. This balanced overview of Monarch’s pros and cons will assist you in determining if it suits your financial management style and needs.

Pros of Monarch

- Comprehensive Financial Integration: Monarch excels at integrating a wide range of financial data, including bank accounts, investments, and real estate, providing a holistic view of your financial health in one platform.

- Flexible Subscription Plans: Users can choose between monthly and annual subscription plans, offering flexibility depending on their budgeting preferences and financial commitment level.

- Advanced Investment Tools: Unlike many budgeting apps, Monarch provides robust tools for tracking investments, offering insights into portfolio performance and asset distribution, which are invaluable for users actively managing their investments.

- Intuitive User Interface: The platform features a modern, clean interface that enhances user experience by making it easy to navigate and understand complex financial data.

- Dynamic Alerts and Notifications: Monarch’s customizable alerts keep users informed about important financial updates and potential issues, enabling proactive financial management.

Cons of Monarch

- Higher Cost for Monthly Subscription: The monthly subscription rate is higher than the annual rate, which can accumulate to a significant amount over time, making it less cost-effective for long-term use.

- Less Established Community: As a newer tool, Monarch’s community is not as large or active as some long-standing platforms, which may affect users looking for extensive peer support and shared user knowledge.

- Potentially Overwhelming Features: The breadth of features and data integration might overwhelm users who are new to financial management or those who prefer a simpler budgeting focus.

- Limited Third-Party Integrations: While Monarch integrates well with financial accounts, it may not offer as many third-party integrations as some users might need, potentially limiting flexibility in connecting with other tools.

Conclusion: Which Tool Wins for Your Finances in 2024?

Choosing between YNAB and Monarch ultimately depends on your specific financial goals, your comfort with technology, and what features are most important to you in a budgeting tool. Both platforms offer robust features designed to help users manage their finances more effectively, but they cater to slightly different user needs.

YNAB is ideal for those who are looking for a tool primarily focused on budgeting and financial planning. It encourages a proactive approach to managing money with its unique philosophy of giving every dollar a job. Coupled with extensive educational resources and a supportive community, YNAB is particularly well-suited for individuals new to budgeting or those who need a structured program to manage their finances.

On the other hand, Monarch offers a more comprehensive solution for those who need an all-in-one platform that not only handles budgeting but also provides detailed insights into investments and net worth. Its ability to integrate a wide range of financial data makes it a great choice for users who are more experienced in financial management or who need a detailed overview of their financial health.

Ultimately, the decision between YNAB and Monarch should be based on which features align best with your financial management style. If you prioritize educational content and a community-oriented approach, YNAB may be the tool for you. However, if you seek comprehensive financial insights and enjoy managing all aspects of your finances in one place, Monarch could be the better option.

In 2024, as financial technologies continue to evolve, both YNAB and Monarch offer strong platforms that can help users achieve their financial goals. By considering your personal needs and the specific advantages of each tool, you can choose the right solution to enhance your financial well-being and ensure that your budgeting method complements your financial aspirations.